ev tax credit bill text

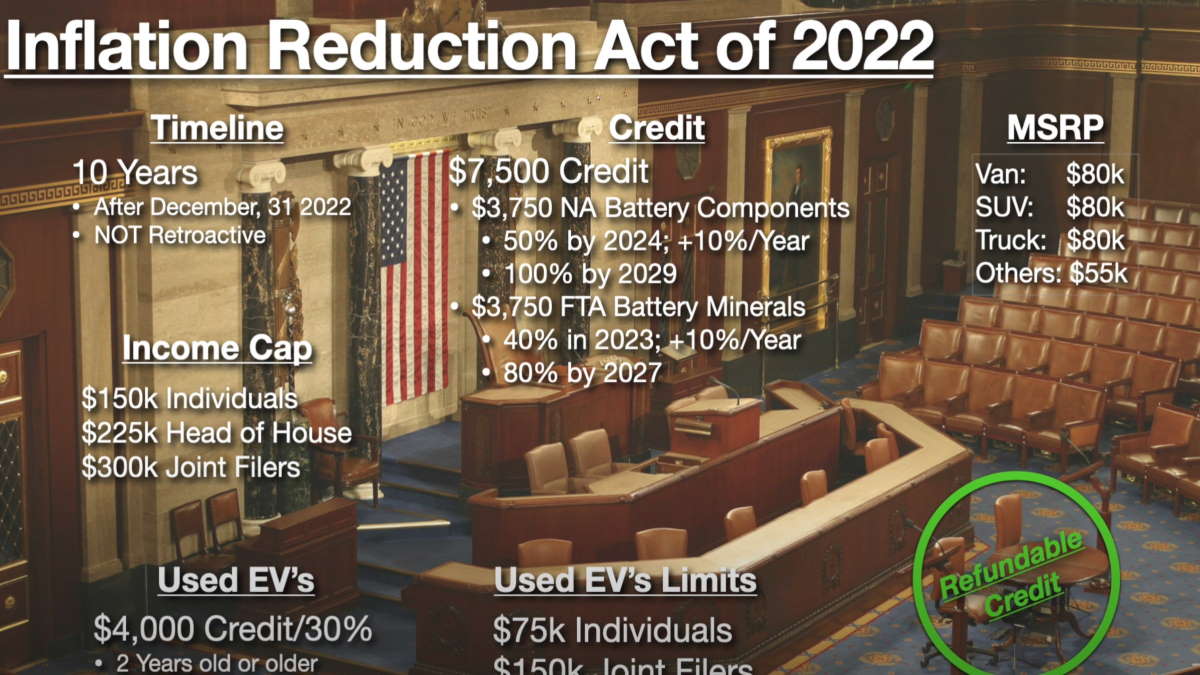

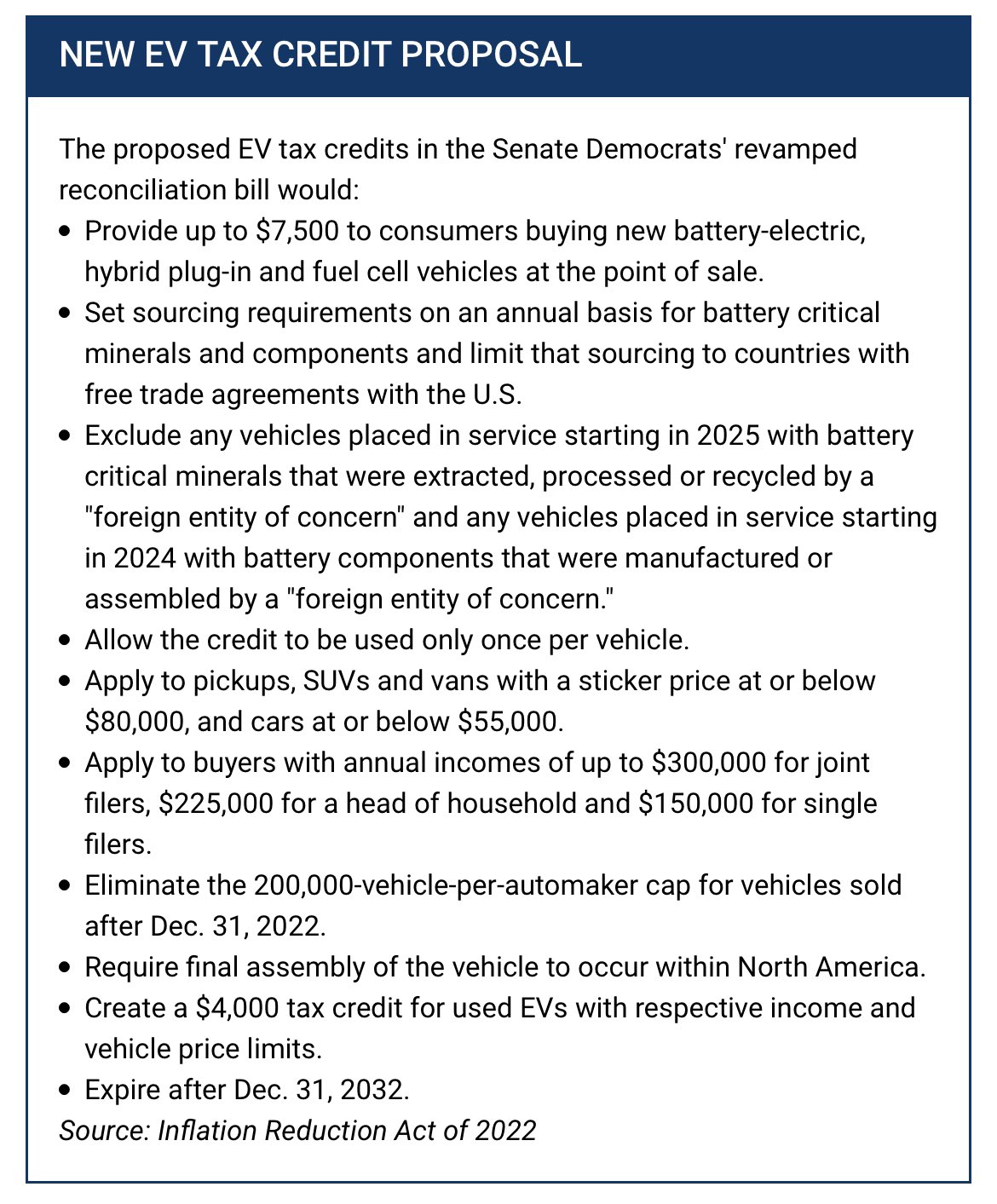

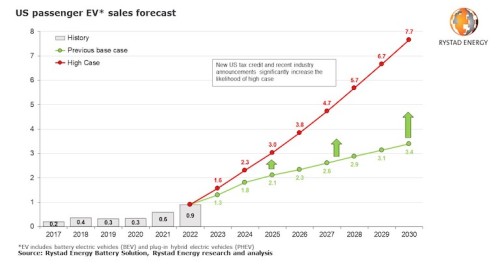

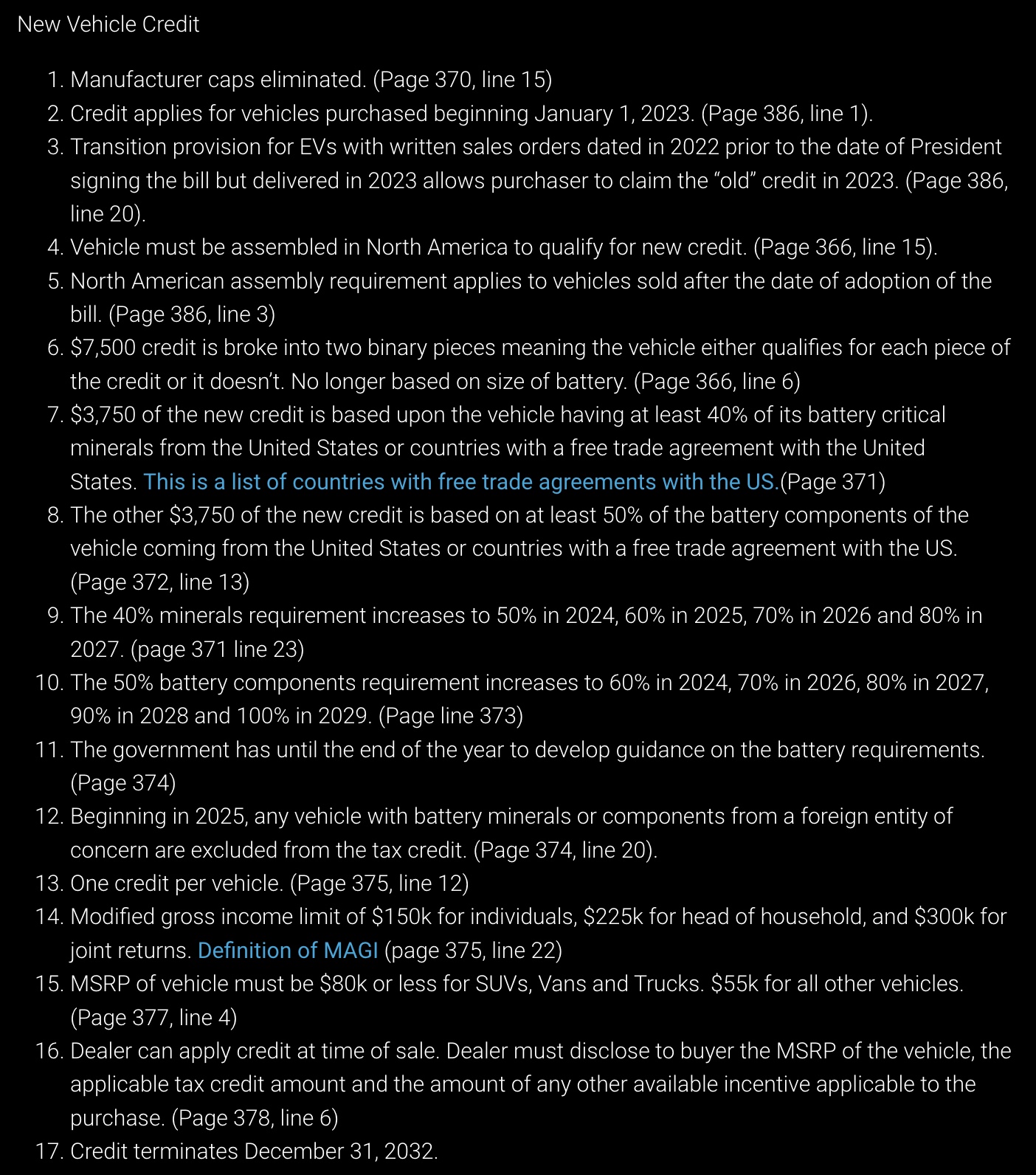

When President Biden signed the Inflation Reduction Act on August 17 a new rule took effect requiring that final assembly of EVs must occur in North America to qualify for a EV. Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite.

Some Electric Vehicles Ineligible For 7 500 Tax Credit Verifythis Com

The credit begins to phase out for a manufacturer when that manufacturer sells.

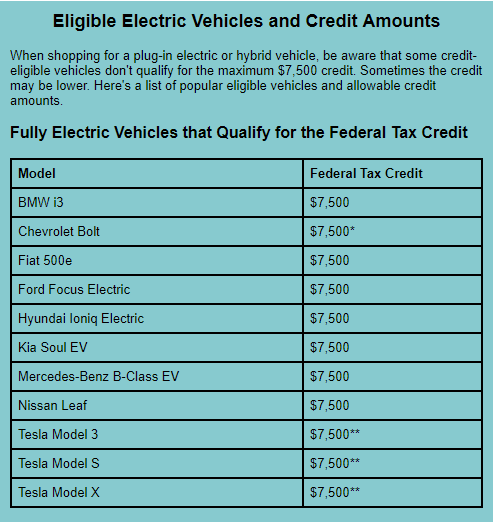

. The credit ranges between 2500 and 7500 depending on the capacity of the battery. A Imposition of tax 1 I N GENERALParagraph 2 of section 55b is amended to read as follows. The EV sticker price matters.

Price matters but not until January 1. The new tax credits replace the old incentive. The Plug-In Electric Vehicle Tax Credit by Molly F.

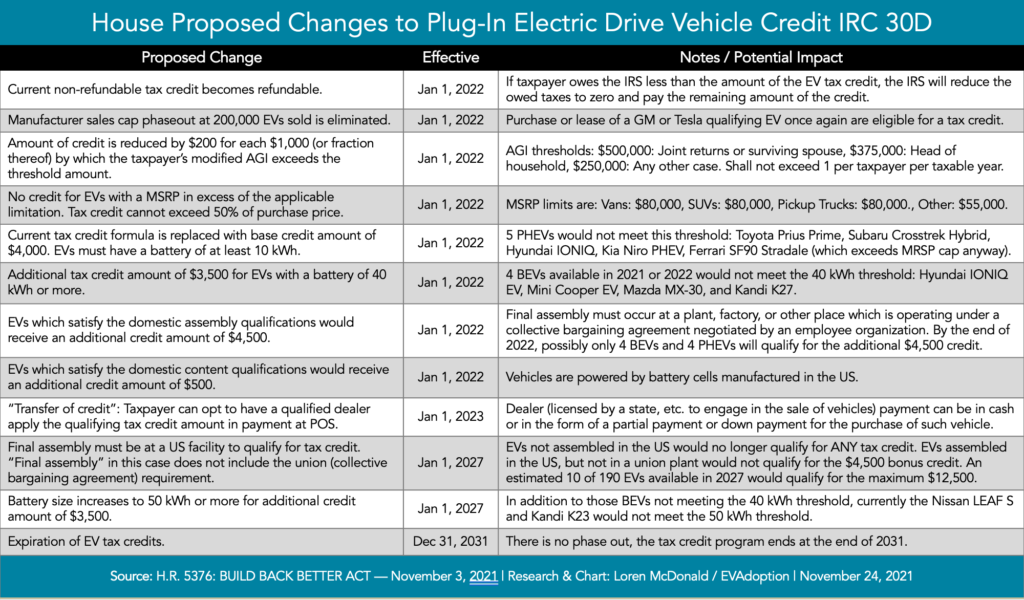

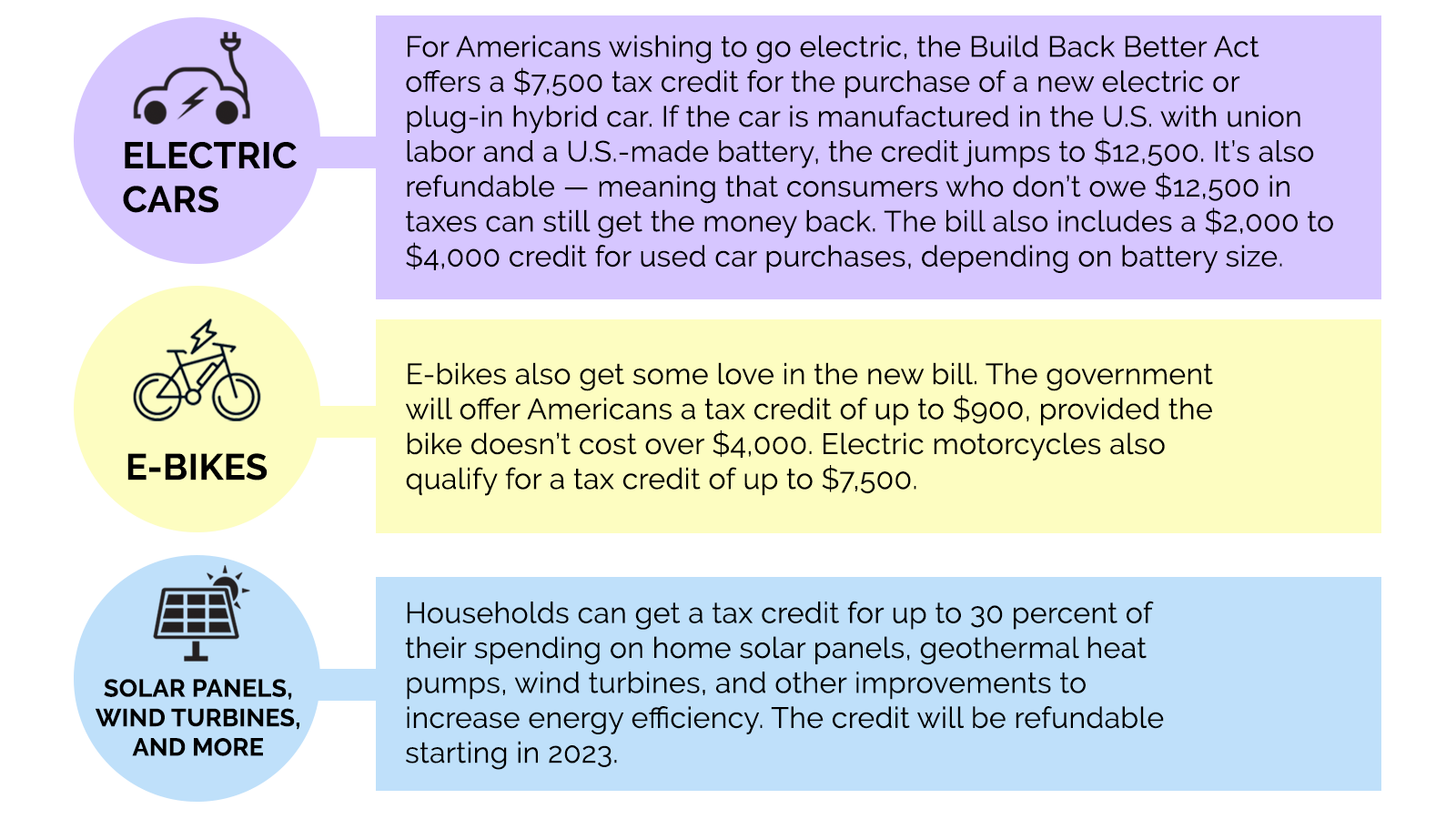

Electric vehicle tax credit. If the Build Back Better bill passes both the House and Senate it will make the EV tax credit refundable which would. This bill which is being voted on right now would do away with the 200000 vehicle limit that Tesla and GM have exceeded.

Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. Tax Credits for Clean Vehicles Purchased in 2022 Multiple factors determine whether an EV purchased in 2022. Here is the text of the House bill HR 5376 as of.

The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. The SUV cutoff is at 69000 while the maximum eligible price for a pickup truck is 74000. Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite.

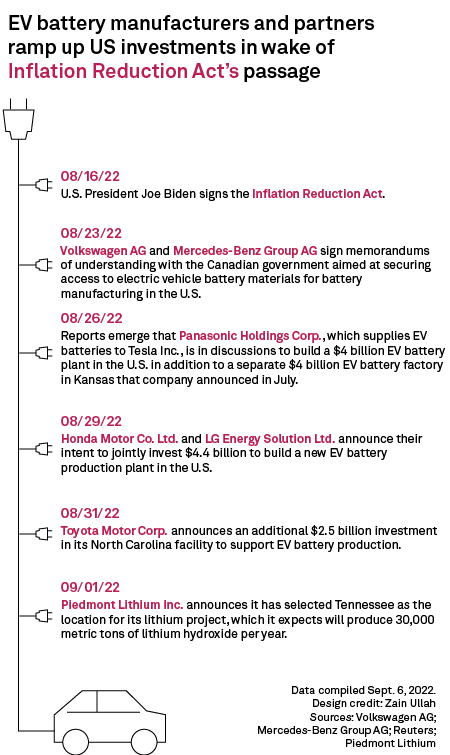

Important Information About Tax Credits. Raphael Warnock introduced a bill Thursday. Congress recently passed new legislationthe Inflation Reduction Act of 2022which changes credit amounts and requirements for clean energy.

Keep the 7500 incentive for new electric cars for 5 years. According to the bill minivans provide a tax credit if their MSRP is 64000 or less. The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as 500 if.

19 its a solid maybe. The new electric car tax credit is easier to claim and extended to 2032 to US-built EVs along with a new 4000 credit on used EVs. As of Dec.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. 2 C ORPORATIONS A A PPLICABLE CORPORATIONSIn. Under the bill buyers of previously-owned electric vehicles would be eligible for a 4000 credit or 30 off the cost of the vehicle whichever is less.

But there are caveats here. Tesla has used up the current 7500 rebate as has GM. Under the bill the expanded tax.

The bill extends the tax credit for new qualified plug-in electric drive motor vehicles. This bill modifies and extends tax credits for electric cars and alternative motor vehicles. The South Korean automaker complained new tax credit policies could complicate the companys plans to build a 55B factory in Georgia US.

New battery electric cars that cost more than 55000 do not qualify for the EV tax credit.

New Us Climate Bill Seeks To Onshore Electric Vehicle Supply Chain White Case Llp

Ev Tax Credits Are Coming Back How Tesla Benefits Torque News

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Pkf Mueller

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Everything To Know About The Biden Administration S New Ev Subsidies The Week

Whole Mars Catalog On Twitter The New Ev Tax Credit Proposal In The Inflation Reduction Act Of 2022 Via Automotive News Https T Co Ngp8vfpsyc Twitter

Ev Announcements Snowballing Post Inflation Reduction Act S P Global Market Intelligence

Complicated New Us Ev Tax Credit Bill Page 5 Fisker Ocean Forum

Us Inflation Reduction Act Ev Manufacturers May Be Forced To Rethink Battery Sourcing While The Secondhand Market Gets A Boost Ajot Com

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

A Complete Guide To The New Ev Tax Credit Techcrunch

Fred Lambert On Twitter Here S A More Detailed Look At The Ev Tax Credit Reform That The Senate Is Expected To Make Happen Thanks To Chris Stidham Https T Co Yhwk7mn4cv Https T Co T6rbzuwuhn Twitter

Tax Credits For Electric Vehicles What S Changed With The Us Ira Mayer Brown Tax Equity Times Jdsupra

Green Incentives Usually Help The Rich Here S How The Build Back Better Act Could Change That Grist

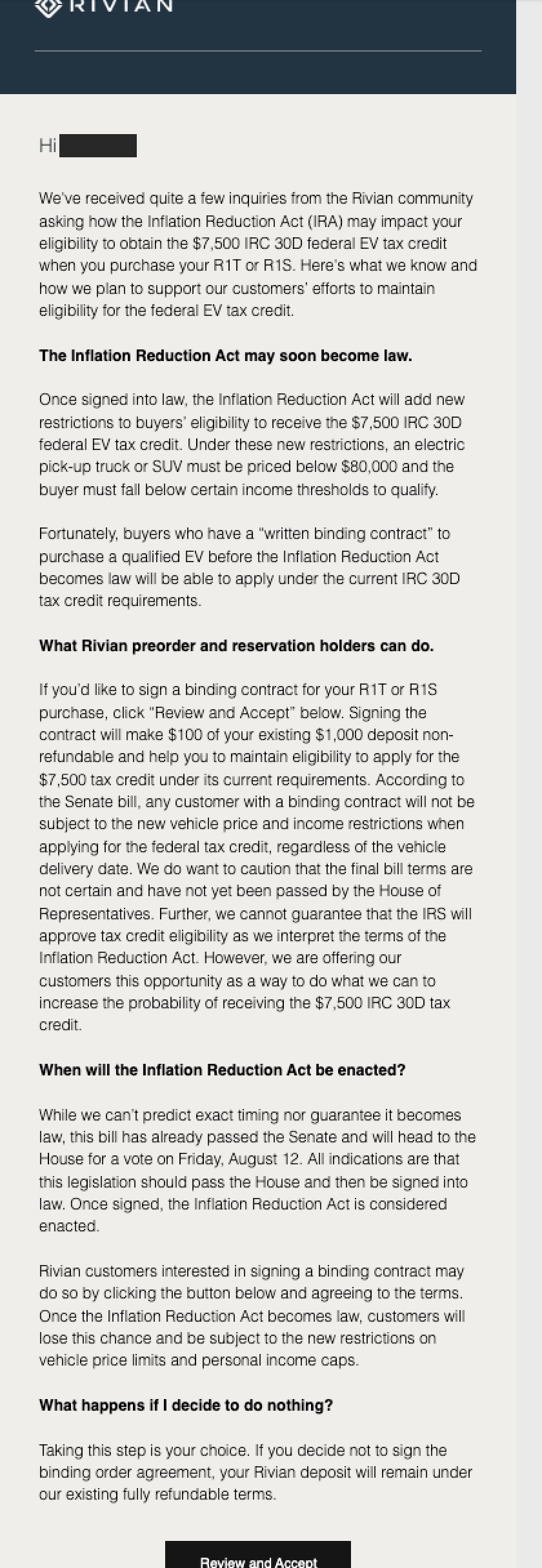

If You Want An Ev Buy Now Rivian Fisker And Others Rush To Lock In Ev Tax Credits Before Changes Electrek

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

.jpg)